Our Investing Thesis

Our investments are concentrated in global categories poised for disruption or net new markets that have the potential to transform the way we live. Our category focus evolves as new trends emerge.

During our last Twelve-Month period ending on March 31, 2017, TechSprout is pleased to announce that we have made 6 new investments and 10 Follow-On investments in Real Estate, Fintech, Health Tech, and Transportation & Logistics. We’ve successfully delivered 86m in (total) Distributions. Capital invested grew to 1.3b with 637m in LTM investment loss. Composition by Geographics are 46% US, EMEA 18%, and Asia 36%.

Cumulative Investment gains achieved $0.4b (after distributions). All details were released to Investors on April 1, 2017.

********

Footnotes:

- Capital Invested refers to the dollar amount invested in new and pre-existing portfolio companies by TechSprout during the twelve month period ended March 31, 2017. New Investments refer to the number of new companies added to TechSprout’s portfolio during the twelve month period ended March 31, 2017.

Follow On Investments include both secondary purchases of shares, and investments made in the subsequent rounds of financing raised by pre-existing portfolio companies during the twelve month period ended March 31, 2017.

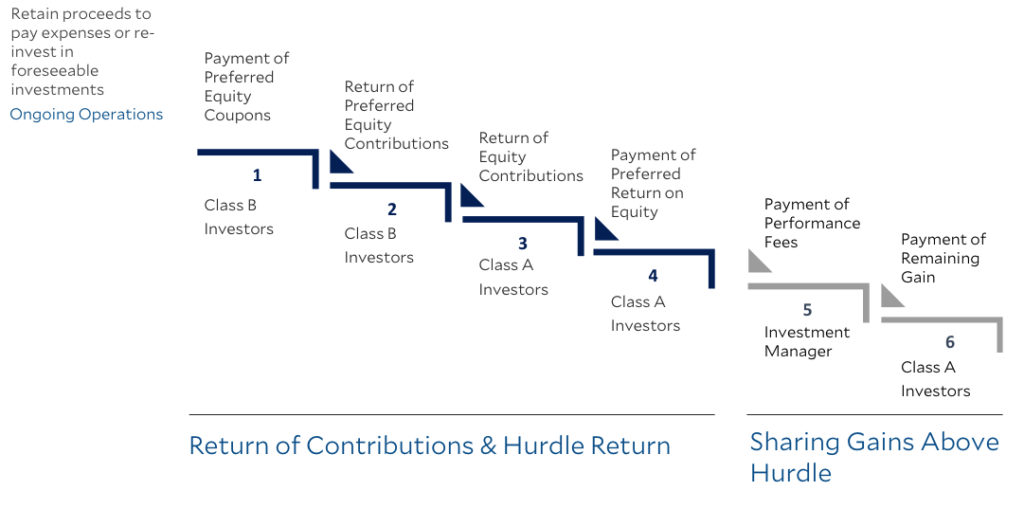

2. Distributions include Realized Proceeds and Preferred Equity Coupon distributed or paid to Limited Partners during the twelve month period ended March 31, 2017. They are net of Return of Recallable Utilised Contributions that were simultaneously retained and reinvested and do not include the Return of Recallable Unutilised Contributions.

Accordingly, the actual realized gains or losses may differ materially from the values indicated herein.